Living a frugal lifestyle doesn’t mean sacrificing quality of life; in fact, it’s quite the opposite. It is about making conscious choices that align with your financial goals and values. Here are top 10 frugal lifestyle tips to help you save more.

Undoubtedly, things have become more challenging in present society. Everyone has to adapt in one way or the other to ensure that they have a soft cushioning to life. It is why I have been advising everyone to start adopting a frugal lifestyle.

Embracing frugality can lead to a more mindful, meaningful, and financially secure existence. Whether you’re looking to save money for a specific goal, reduce waste, or simplify your life, these top 10 frugal lifestyle tips can guide you on your journey.

Table of Contents

10 frugal lifestyle tips to save more

With the rising inflation and high cost of living, it really difficult to save. Even with the salary increases to match up with the cost of living, there is little you can save.

Here are my top 10 frugal lifestyle tips to help you save more in 2024.

Work with a budget

I cannot imagine living life without having a budget. If you do not work with a budget, you will keep on spending and spending, without keeping track of your expenses. In no time, you will become overwhelmed and stay lamenting about how tough life has become.

When you work with a budget and stick to it, you know where every dollar goes as it helps you track your income and expenses. If you struggle with budgeting, you can use a budgeting app or spreadsheet to monitor your spending habits. It helps you know areas where you can cut back.

I personally use excel sheets to do my budgeting and tracking. But if you would rather use an app, you can check for available options and pick the easiest one for you.

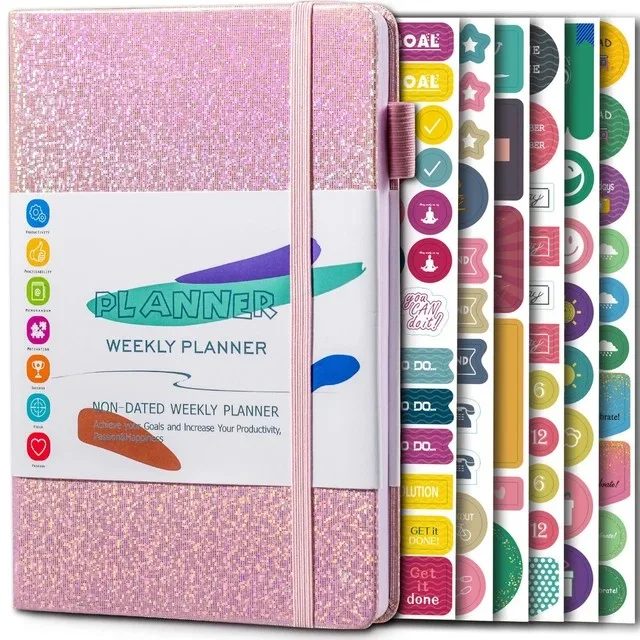

I am more of a pen on paper girly. So I use paper planner for my budgeting. This help me keep in check my spending and save more. I have linked a planner below you can use from Aliexpress.

Limit eating out

I’m sure you’re familiar with the phrase ‘there is food at home.’ Yes, you will save more when you stick to cooking at home as eating out frequently will significantly impact your budget.

By meal planning and cooking at home, you can save money and enjoy healthier meals. Batch cooking and using leftovers creatively can also reduce food waste and further stretch your food budget.

Many of us are guilty of always wanting to grab a quick takeout, myself inclusive. Whenever I get this urge, I quickly remind myself that there is food at home. Else, I would spend all my salary on takeouts.

Have a priority list

They’ve been teaching us about prioritizing from secondary school, and it plays out even in adult life. Before buying new, ask yourself if you really need the item or if something you already own can serve the same purpose.

No, it is not starving yourself of what you need. Sometimes, what you think you need actually classifies as a want. Repairing and repurposing items not only saves money but also reduces waste.

Working with a priority list helps you be less wasteful and ensures that you stay on track when it comes to savings. You will be thankful for it.

Go Thrifting

I know you may be twitching your eyes while reading this point. But trust me, shopping second-hand is not as bad as they make it seem. Thrift stores, garage sales, and online marketplaces are treasure troves for finding quality items at a fraction of the cost. Clothes, furniture, and even electronics can be purchased second-hand, saving you money and supporting the recycling of goods.

This is not to say that if you have the money or means, you should not buy things in brand new forms. But if you’re looking to save more, this frugal lifestyle tip will come in handy.

Automate Your Savings

There’s something about humans and procrastinating when it comes to savings. Money enters your hand and you say you will save a certain amount of it. Then, you keep procrastinating until the money finishes. When this happens, you promise yourself that it won’t repeat itself. However, it becomes a recurring cycle.

I’m sure we can all relate to such scenarios. However, you can make saving money effortless by automating transfers to your savings account. For example, you can automate your savings with platforms like Bitnob and decide to be debited $1 daily. The key to automating savings is to do what works for you and not try to copy someone else.

To sign up for bitnob, use my referral code magdalene8 to support the blog.

Recycling is Bae

I like to look at the bigger picture when it comes to my actions and inactions. This way, I not only cut down on my excesses, I also contribute to the environment. If you’re looking for a key champion of being eco-friendly, I should be an ambassador.

I can come up with lots of reasons why we should adopt recycling and be eco-friendly, especially as it expands our lifespan.

But for the purpose of this article, I’ll love to remind everyone that adopting a minimalist approach by reducing what you consume can lead to significant savings. Yes, reusing items and recycling materials can also cut costs and benefit the environment.

Cut Down on Utilities

Understandably, living a frugal lifestyle can be tough. It’s why you always have to remind yourself of the reasons why you started doing it in the first place.You want to save more? Then you should cut down on utilities! You can start by rationing how you use your ACs.

Simple changes like turning off lights when not in use, fixing leaks, and investing in energy-efficient appliances can reduce your utility bills.Also, consider also reducing your water usage and managing your heating and cooling systems more efficiently. Doing all these will help you save more.

Cancel Unnecessary Subscriptions

Often, I wonder how people with numerous subscriptions keep up, especially as we are in a fast-paced society. The other day, I noticed that I’m subscribed to almost all the movie streaming platforms, yet I rarely watch movies. It made me begin analyzing my spendings, and how much I would save if I cancel certain subscriptions.

Yes, it’s time to review your monthly subscriptions and memberships. Cancel anything you don’t use regularly or that doesn’t add significant value to your life. Got 5 book apps? Remember, libraries offer free access to books, magazines, and even digital content on YouTube.

Do you know you can watch a full movie on YouTube? Also it is for free, just subscribe to the channel to get notified. If you love to watch travel vlog and fashion hauls, subscribe to my youtube channel, MaggiesMemoir.

Embrace Free Entertainment

Exploring free entertainment options such as community events, parks, and hiking trails is a great way to save more. People are often of the mindset that socializing/ networking always has to be expensive. But, socializing doesn’t have to be expensive.

With options like potlucks, game nights, and home movie screenings, you can have fun and still stay budget-friendly.

If you’re in Lagos Nigeria, I have written a round up list of free things to in Lagos. These places are free to access like Bogobiri house, New Afrika Shrine etc.

Quality Over Quantity

When you do need to purchase something new, opt for quality over quantity. Investing in items that are durable and long-lasting may have a higher upfront cost but can save you money in the long run by reducing the need for replacements.

Which of these frugal lifestyle tips will you be implementing to help you save more? Are you finding it difficult to save due to low income, these 10 frugal lifestyle tips will come in handy for you.

Feel free to comment below your thoughts. Ciao.